The term “goods to person” in the context of the logistics and supply chain sector refers to technology that brings items from locations within, for example, a warehouse to a human picker while he or she remains in one place, also within the warehouse.

And while “logistics” and “supply chain” are terms that are often used interchangeably, logistics usually refers to moving goods along public roads or out in the wider world, whereas supply chain refers to the entire journey that the goods make, as well as specific parts of it, such as their processing through a warehouse.

One of the technologies most readily associated with medium- to large-scale warehouses is the conveyor, which has been around for more than 100 years. But in the past few years, warehouse robots have been eroding the total dominance of conveyors by offering what are offering described as “flexible” supply chain systems, in contrast to the “fixed” nature of conveyors.

Both conveyors and warehouse robots can be described as “goods-to-person” systems:

- a conveyor moves boxes full of various items through the warehouse, and human workers can be waiting at various points along the conveyor to pick out the specific items they need to fulfill an individual order from a customer; and

- a warehouse robot can move boxes or entire shelf units through the warehouse to the human worker so he or she can remain stationary and simply pick out the items they need to fulfill a customer order.

The human picker – and the picking station – is central in both these scenarios. And although picking items might seem like it’s technically a simple job for a human, it’s not at all straightforward for a robot.

A number of companies are developing robotic solutions to try and replace the human picker, but at the moment, the human picker is the fastest and most reliable solution for this job.

It’s not often you can say that a human is faster and more reliable than a robot, but that’s the way it is right now in picking, so there’s not going to be much change there for a while.

But what is changing quite significantly is the technology surrounding the human picker or the picking station. The big transformation is the emergence of warehouse robots as a viable alternative to conveyors. Although robots are still a relatively small percentage of the overall supply chain market, an increasing number of warehouse managers are choosing robots over conveyors.

Additionally, there are many warehouses that do not use conveyors or robots. Some estimates suggest that as many as 70 percent of warehouses are still manual. They might use an all-human workforce and system, with just traditional warehouse infrastructure. Or they might also use some vehicles such as forklift trucks and automated guided vehicles. AGVs are technically different from robots, which are often referred to as autonomous mobile robots, or AMRs.

Conveying robotics and automation

The difference between an AGV and an AMR is in the “a” – automated or autonomous. An AGV usually requires the placing of magnetic strips on the ground to guide it through the warehouse, or it can be led around by a human.

Meanwhile, an AMR requires only its internal mapping and artificial intelligence system to navigate, as well as recharge itself. And, increasingly, the AI within AMRs can mean they organise the warehouse in a way that fast-moving goods are located nearer to the picking station.

For companies such as Geek Plus Robotics, a supplier of warehouse robots, this hybrid technology landscape presents a once-in-a-generation opportunity.

The relatively new startup company is probably the leading supplier of warehouse robots in the world, having sold more than 7,000 units since its founding in 2014. Its success in this market has led it to develop ideas such as a driverless forklift truck, which it is already offering to the market.

Also, Robotics and Automation News has seen Geek Plus documents which show that the company is considering developing what’s called a “delivery robot” as part of its “smart logistics strategy”. More on that as we get it.

Geek Plus predicts that the growth of e-commerce is placing additional demands on the supply chain and logistics sector, and some of the established giants do not have enough time or resources to provide the high level of customer services that it can to smaller and medium-sized companies.

Material handling, as the term suggests, refers specifically to the movement of goods or items. This could be moving the material between a truck and a warehouse, on or off the truck, or in any similar situation. You could perhaps think of it as the area where logistics connects with the supply chain.

There are numerous multi-billion-dollar material handling companies which specialise in supplying material handling services, but according to the Geek Plus spokesman, some of them find themselves having to sometimes turn away all but the largest customers because they simply don’t have the resources to allocate to anything else other than the larger, multimillion-dollar projects.

“The large integrators are concentrating on jobs that are valued at tens of millions of dollars, and are actually turning down small- and medium-sized projects that might be worth half a million to a million,” he said.

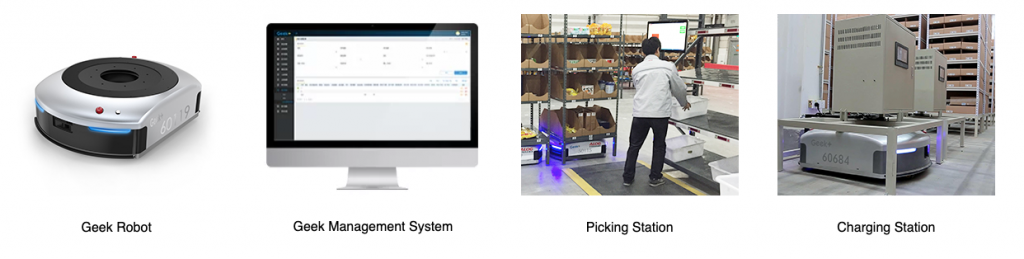

A typical Geek Plus picking system consists of robots, robot charging stations, management software, and picking station, as well as shelf units that are compatible with the robot. (See image above.)

Among the main advantages of a robot-based warehouse is that it can be installed faster and at a lower cost. The return on investment can, therefore, be achieved sooner.

But each warehouse operation has its own requirements, and conveyors are generally chosen by warehouses have the highest volumes and throughput of products.

Branching out

It has been noted by experts within the field of warehouse robotics that the root technology the robotic vehicles use is essentially very similar to what you might find in autonomous vehicles outside of the warehouse. For example, driverless cars.

It’s a completely different level of sophistication and complexity, but basically, what we’re talking about are vehicles that can move autonomously and find their own way around a location.

Having said that, and to emphasise again, there is a world of difference between an autonomous car that is designed to drive along public roads and an AMR that operates exclusively within a warehouse.

But there is a relatively new machine that might be regarded as “bridge” in-between those two technologies, and that is the delivery robot.

The term “delivery robots” – within this sector at least – specifically refers to robots that deliver items using public footpaths and roads. They can, of course, be used in warehouses as well, or any other location, but they’re not really designed for that.

Robotics and Automation News recently published a list of the top 20 delivery robot companies, which shows that this is a technology that is growing and evolving very fast. Who would have guessed that so many companies were already in this space?

Moreover, research suggests that the market for delivery robots will grow from about $12 billion last year to $34 billion by 2019.

The difficulties in categorising new technology – or our own lack of understanding – means that sometimes we overlook companies like Savioke, which produces a delivery robot of sorts. But that company has mainly been concentrating on supplying its robots to hotels, and the machine designed to carry very small items over short distances.

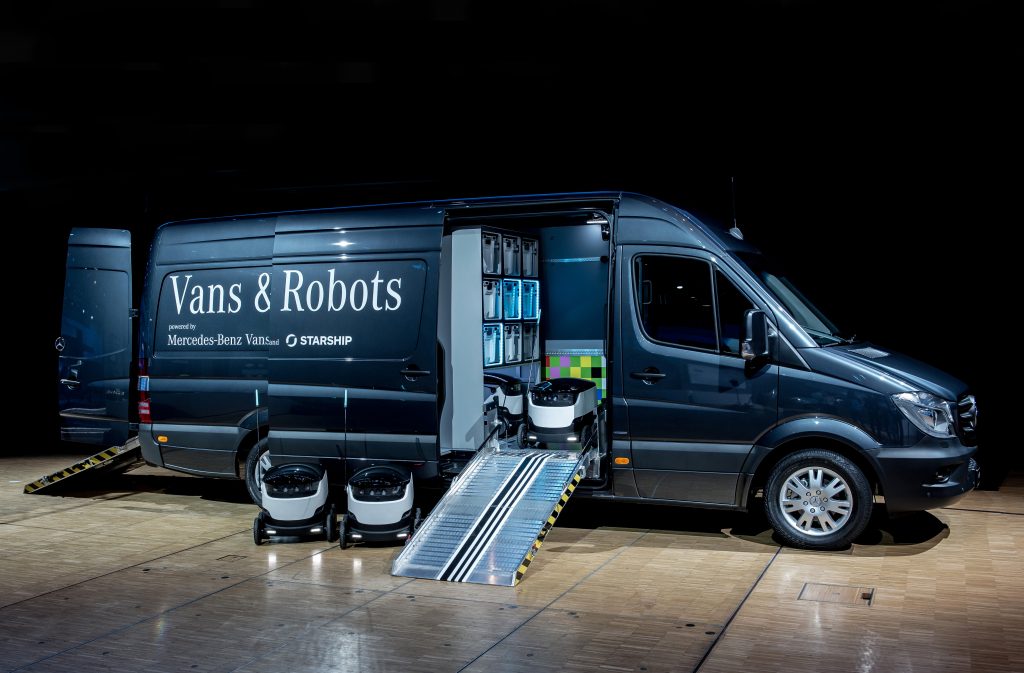

Perhaps the standard or typical delivery robot is produced by a company called Starship Technologies, which has developed a partnership with Mercedes, as illustrated in the picture above. The obvious implication is that robots are very likely to be integrated with traditional logistics vehicles.

Starship has also recently found significant commercial success in supplying its robots to university campuses, teaming up with food services company to supply what they describe as “the world’s largest fleet of delivery robots on a university campus” – which is about 25 robots in one place.

Universities are ideal grounds for delivery robots right now because they are enclosed spaces controlled by one management body, similar to an airport or large manufacturing facility or industrial park. This avoids all the difficulties of operating in public spaces, which are sometimes regulated in a way that is not welcoming to delivery robots sharing sidewalks with humans.

For example, San Francisco last year effectively banned delivery robots from its sidewalks until an acceptable regulatory framework was developed. But other states, such as Washington, are more accommodating, and tests are being carried out by a variety of companies – most notably, Amazon – in partnership with local authorities across the US.

Similar tests within frameworks of public-private partnerships are also being carried out in Europe.

The Chinese way

While the US and Europe develop what will probably end up being detailed regulations governing the operation of delivery robots in public spaces, delivery robot companies appear to have been given almost total freedom of the streets and roads by their government.

Maybe it’s because the Chinese government is newly enthusiastic about the latest technologies, such as artificial intelligence and all things robotic. Or – more likely – it’s basically a gap or loophole in the regulations surrounding vehicles that operate along sidewalks and roads.

How many people really understand this technology and its future effects on society anyway? Some might say, for example robots puts humans out of work. But even in China, logistics companies are finding it difficult to recruit humans to deliver parcels, and that labour shortage is very likely to get much worse over time.

That’s not to say there are no regulations concerning delivery robots at all. China? Of course not.

Speaking to Robotics and Automation News, a senior executive of Zhen Robotics explained that his company’s delivery robot does not enter residential building complexes. Rather, it stops at the main gate and notifies the intended recipient.

“The intended recipient then comes out to the main gate or entrance and picks up their items from the robot,” he said.

He added, however, that regulations in China relating to delivery robots is a “huge grey area”.

Interestingly, Zhen Robotics produces four types of robot, including one which is a warehouse robot, or AMR. (One of the robots can be seen in the picture below.) It’s probably the only company which currently produces a robot for warehouses and a robot for on-street delivery.

Another delivery robot company which has been growing fast in China is Neolix. (See picture above.) We didn’t know much about this company until recently and have had to update the top 20 delivery robots list as a result.

We had originally thought that a robot pictured being used by Cainiao was developed by Cainiao itself – Cainiao being a massive logistics company that is majority-owned by e-commerce giant Alibaba.

But, in fact, that robot Cainiao is showing off was actually developed by Neolix.

A spokeswoman for Neolix confirmed this and provided a few more details about the startup. Not only is Neolix partnering with Cainiao, it is also working with Baidu, China’s equivalent of Google.

Moreover, Neolix is expanding into Europe, where it is preparing a test program that starts in September. While she would not provide details of the test, or which European company it is, she did say that Neolix has received many enquiries from numerous European countries about its product.

“In China, we have about 200 of our robots in operation,” she said. “Most of them are used as mobile vending machines. They are about 3 metres long and 1 metre wide, and can be stocked with a variety of items.

“One of these units is currently located in one of the largest public parks in Beijing.”

The Neolix vehicle is claimed to be the “world’s first level 4 unamanned vehicle”, level 4 referring the global engineering association SAE’s definition “high automation”, the highest level being 5. (See SAE levels of automation for vehicles.)

Vehicles similar to those manufactured by Nelix are being developed in the US. Perhaps most notable is the “mobile grocery store” supplied by San Francisco-based Robomart to retailer Stop & Shop.

Another notable delivery robot maker is Nuro, which makes a “self-driving vehicle for local goods transportation”, as the company describes it. The company is currently partnering with retailer Kroger to develop what they describe as “shopping delivery services”.

Almost instant delivery

So this overview of the current technologies being developed and tested in the logistics and supply chain sector seems to suggest that a new last-mile delivery solution is emerging. This new solution – whatever its form – is unlikely to replace the human-operated delivery vehicle anytime soon, but it has already gained a significant market share and will continue to grow.

Additionally, last-mile delivery robots combined with warehouse goods-to-person robots are likely to make the e-commerce logistics and supply chain even faster than it is now.

At the moment, only some places in the world can offer to deliver an order with the “same day” or within “an hour or two”. It’s difficult to believe that this kind of timeframe exists let alone it being in the process of becoming the standard in the majority of places in the world, certainly in urban areas.

But that looks to be the way things are going, and it is opening up new areas of the market for existing companies as well as new and nimble startups of all kinds.